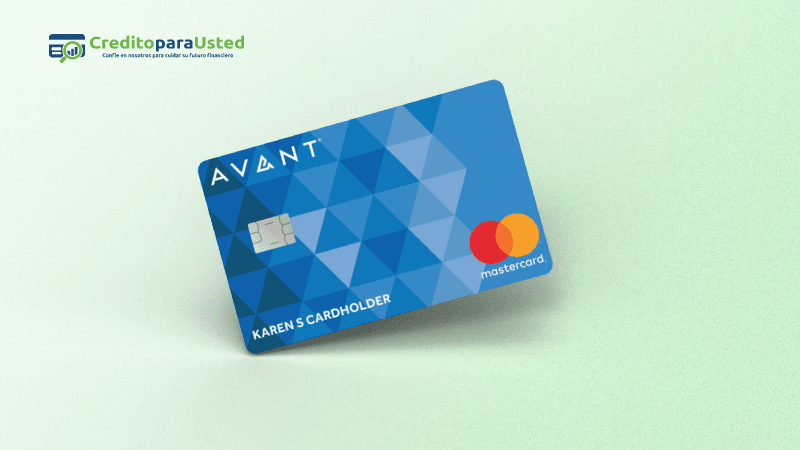

If you're new to credit or have made some mistakes, it can be hard to find a card that doesn't require a security deposit up front. But the Avant card is unsecured, so you won't have to fork out anything to get it.

| Positive points | Negative points |

|---|---|

| No foreign transaction fees | Proof of Income Requirement |

| No security deposit | Annual Fee $ 59 |

One of the most attractive features of the Avant credit card is that you can pre-qualify with a soft credit check to see what rates and fees you will qualify for before you submit your application.

The Avant credit card also reports your payment behavior to the three major credit bureaus, a must for anyone trying to improve their credit standing.

| Benefits | |

|---|---|

|

Online

|

100% online application process |

|

Service

|

24-hour customer service |

|

Card Flag

|

Mastercard |

|

Advantages

|

Several benefits and advantages |

No foreign transaction fees

The Avant credit card charges no foreign transaction fees, making it a fair choice for cardholders planning to spend abroad. Many cards charge a fee of around 3% of every transaction made abroad, including some of the best credit cards on the market. Click the button below to request your card:

I Want My CardNo security deposit

Unlike secured credit cards, an unsecured card like the Avant card does not require a security deposit up front. While these deposits are refundable when you close your account, they can be a hindrance if you don't have much cash on hand or if you'd rather avoid holding cash for several months.

Credit history

The Avant credit card is designed to help cardholders who have no credit history or an average credit score build their credit with a credit card, so while it may be useful in that way, you shouldn't expect much in the way of benefits and cardholder benefits, which is fairly common for cards in this category. Click the button below to request your card:

I Want My Card